Any person residing in Malaysia by having principal place of residence One. Both sole proprietorships and LLCs file tax returns that blend the business owners personal income with their business income.

Business Structures In Malaysia

Biztory wholly owned by Vectory Innovation Sdn.

Sole proprietorship vs sdn bhd tax. To register as Sole Proprietor if you are alone or Partnership if with partners at the early stage to reduce operation cost and you can always change into a Private Limited Company Sdn Bhd later on when investors starts knocking on your door or when you are assuming a big liability such as debt above RM2500000 RM500000 to give. If you set up your business as a company sdn bhd you and your shareholders would be protected by the corporate veil. A private company limited by shares incorporated under the Companies Act 2016 which can be identified by its suffix Sdn Bhd Sendirian Berhad.

It is the most common choice for startups or entrepreneurs in Malaysia. Sdn Bhd Corporate Tax Only subject to the 17. Bhd is a type of privately held business entity in which owners liability is limited to their shares.

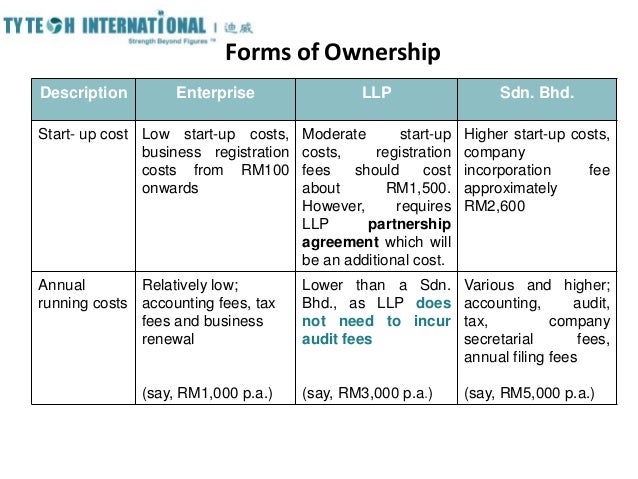

The sole-proprietorship partnership must still obtain the business licenses and permits required for operation however. Sole Proprietorship and Partnership. Characteristically there are major differences.

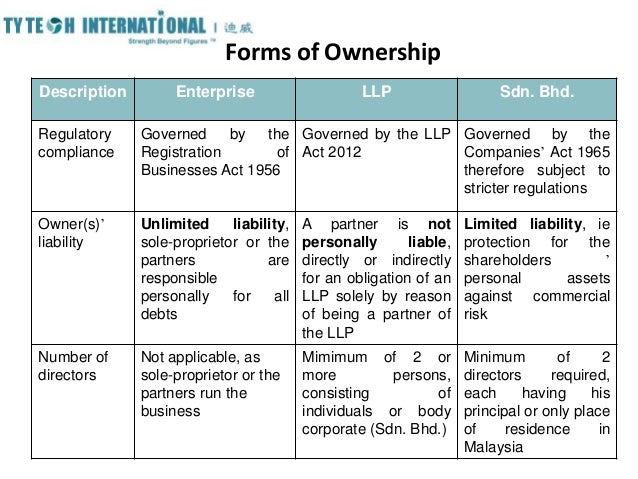

Sep 29 2016 One of the biggest difference between sole-proprietorships partnerships and private limited companies lies in their ability to protect business owners from legal liability should anything go wrong. Sole proprietorships and partnerships are the easiest forms of business to be registered hence the most popular forms of business. What is the differences between Sdn Bhd and Sole-Proprietorship partnership in Malaysia.

Sole Proprietorship Sdn Bhd. The trade tax or corporate tax is fully subsidized in sole ownership business. Sole proprietorship - 1人partnership - 2至20人 Sdn Bhd1至50人 3债务责任.

Jul 29 2020 The differences between a sole proprietorship and a private limited company are summarised below -. There are two type of enterprise ie. Theres little difference between sole proprietorship taxes vs.

Aug 21 2019 A Private Limited Company Sdn. Each has specific characteristics which serve to distinguish it from the other business structures of Malaysia. It must have at least 1 resident director and at least 1 shareholder maximum 50 shareholders.

A single-member LLC is considered a sole proprietor for tax purposes while a multi-member LLC is considered a partnership. An unincorporated partnership conventional partnership. The Profits made are added to the sole proprietor or partners Personal income tax and the owner or partners are liable for this profit under personal income tax.

Thus by switching to a Sdn Bhd 1 July 2020 31 December 2021 Janet would be able to enjoy tax benefit of a total cost saving of RM 28445 in 2021. Sdn Bhd Private Limited Company Sole Proprietorship Partnership. Jun 08 2021 Sole proprietorships partnerships and Sdn Bhd companies are the business structures which a prospective business owner in Malaysia could possibly establish.

Not subject to income tax. However the owner needs to pay a self employment tax. RM 3255 Maintenance Cost of Entity.

In conclusion a private company Sdn Bhd is preferred over business entities with the enforcement of the new Companies Act 2016 which allows for incorporation by sole director and shareholder and at the same time offers limited liability feature. Jan 04 2018 Some of the common options in Malaysia to consider are. Malaysian Citizen or Permanent Resident company name ends with the word Sdn Bhd.

Other types of businesses such as sole proprietorships and partnerships are also liable to income tax. 24 corporation tax rate for small middle size company. Differences between the enterprise and sdn.

An unincorporated business sole proprietorship. Jul 16 2020 Sole Proprietorship Partnership vs. Company Enterprise is one type of business organisation in Malaysia which is the formation bound by the Registration of Business Act.

You can take greater risks to gear up the growth of your business. May 07 2020 Taxation The taxation process is much linear in case of sole proprietorship than that of SDN BHD. It provides a legal entity that is.

Bhd Sole Proprietorship or Conventional Partnerships are subject to fewer compliance requirements - no statutory requirement for annual audit annual general meeting annual returns and etc.

Business Structures In Malaysia